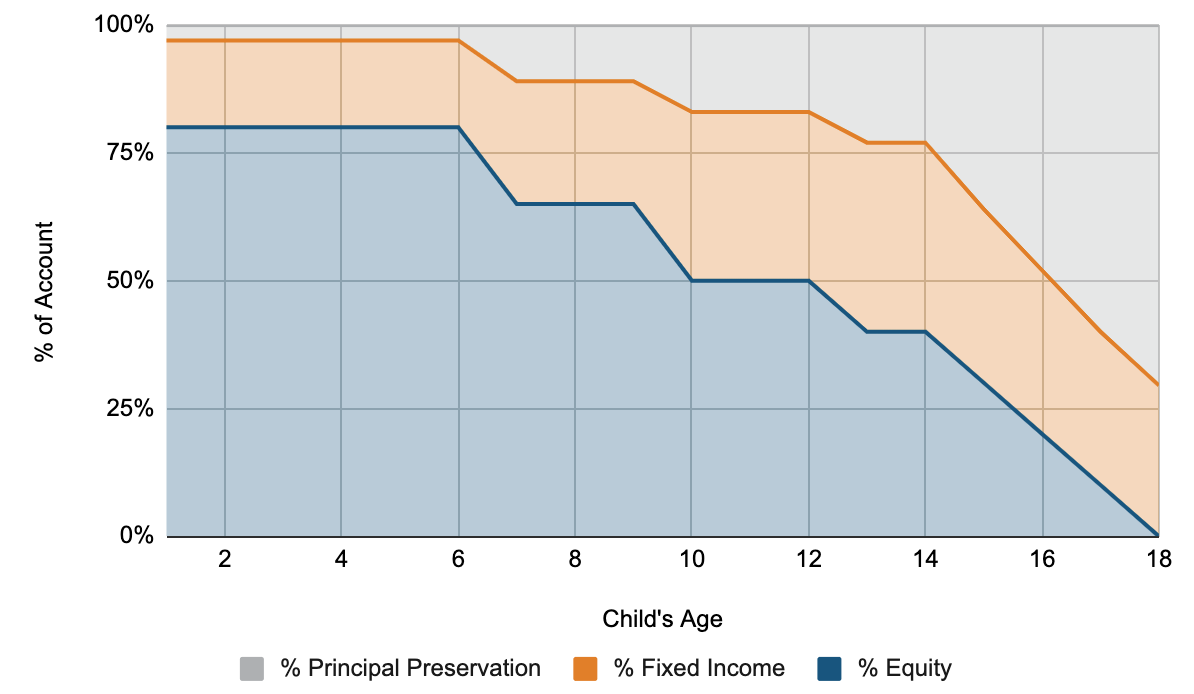

We base our investment recommendation on various factors, including the age of the beneficiary and your risk tolerance. We recommend an age-based portfolio that shifts from riskier investments (equities i.e. stocks) towards more conservative investments (fixed income i.e. bonds), as your child get closer to college (example below). This strategy helps protect your assets as your child gets closer to college and is perfect for a customer that wants an optimized portfolio at all times without needing to make changes themselves.

Sample Age Based Allocation

If you'd like another portfolio, we're more than happy to work with you to set up an allocation that better fits your goals. Please keep in mind, you can only change allocations twice per calendar year.